Ways for LDCs to adapt amid global turmoil

COVID-19 has sent the global economy into a tailspin, and recovery remains highly uncertain until the virus is stamped out. The least developed countries (LDCs), lacking fiscal space to begin with, are likely to face severe economic crises due to reduced exports, tourism receipts and remittance income, coupled with reduced tax revenue.

Added to these woes is a projected decline in foreign direct investment (FDI) by 40%, according to UNCTAD's World Investment Report, which notes three major challenges for LDCs. First, a reduction in FDI or a possible divestment due to pandemic-induced scares coupled with the limited preparedness and capacity of LDCs to respond. Second, an acceleration in already-declining greenfield FDI in the first quarter of 2020 – 20% in value and 27 in number. Third, lower corporate earnings of multinational enterprises affecting reinvested earning potential in LDCs, where the reliance on this source of FDI is relatively high.

Despite these challenges, the LDCs can use the pandemic as an opportunity to attract FDI. Here’s how:

Deepening participation in the global value chain

Due to supply chain disruptions caused by COVID‑19, multinational enterprises are re-evaluating their global footprint and calibrating their sourcing strategies. Although reshoring to home turf is tempting, a safer and potentially more sensible trend is towards diversifying operations and spreading facilities across a number of regions.

The LDCs can attract such investments as they offer two advantages to potential investors: first, having demography on their side, they possess an abundance of low-wage labour; second, they benefit from duty-free and quota‑free market access in their major markets.

That being said, LDCs are not necessarily the most attractive destination for foreign investors due to the lack of appropriate investment ecosystems and several supply-side constraints, including lack of skilled human resources, dilapidated and deficient infrastructure and limited logistics services.

However, these problems are not insurmountable. First, countries can design appropriate policies aimed at attracting investment during the pandemic and beyond. For example, Myanmar has adopted a COVID‑19 Economic Recovery Plan, which, among other things, includes an active investment promotion and facilitation policy, including fast-tracking approvals for investment in labour-intensive and infrastructure projects and a reduction in investment application fees.

Similarly, Benin has been using eRegistration systems to register enterprises through their MonEntreprise.bj platform. It was effectively utilized to register 6,926 businesses enterprises, including 3% of non-Beninese origin, between the start of the lockdown (16 March) and 12 July 2020.

As countries move towards green recovery post-pandemic, there are potential opportunities for LDCs to attract FDI in green, climate-resilient, future-proof and sustainable sectors.

Second, as for the skills deficit, since many LDCs are already witnessing an influx of skilled or semi‑skilled workers returning home from developed and emerging economies, these workers can help to at least partially alleviate the problem.

Third, although infrastructure and logistics services cannot be improved overnight, those LDCs that have already established economic zones (SEZs) and/or industrial parks, where these problems are taken care of to a large extent, can attract FDI by building up their capacity to serve the global production network. Following Bangladesh and Cambodia's lead, other LDCs such as Ethiopia, Myanmar, Nepal, Rwanda and Senegal can also tap into this opportunity.

Tapping into sustainable FDI

There are at least 60 fast-growing market opportunities in areas such as food; cities; energy and materials; and health and well-being – all linked to the achievement of the Sustainable Development Goals (SDGs). These opportunities, which can target sustainable FDI, are valued at more than US$12 trillion annually by 2030.

As countries move towards green recovery post-pandemic, there are potential opportunities for LDCs to attract FDI in green, climate-resilient, future-proof and sustainable sectors. Select measures taken by the LDCs, even prior to the COVID-19 pandemic, that can be replicated in the present context are worth highlighting.

Rwanda provides a good example of offering investment incentives relevant to SDG-related sectors. The country has accorded preferential tax rates to investors that undertake the generation, transmission and distribution of peat, solar, geothermal, hydro, biomass, methane and wind energy. Similarly, Ethiopia created an eco-industrial park in 2016 designed for the textile and apparel industry and powered mostly by hydroelectricity. A dedicated zero‑liquid-discharge facility, enabling the recycling of 90% of sewage, was constructed on its premises.

Tapping into new sources of growth

Many LDCs are now defying the traditional model of structural transformation. Some LDCs are taking advantage of new sources of growth in information and communications technology (ICT) services and digital trade. These provide an opportunity for LDCs to attract FDI in the context of COVID-19, as these businesses can be managed with minimal social contacts.

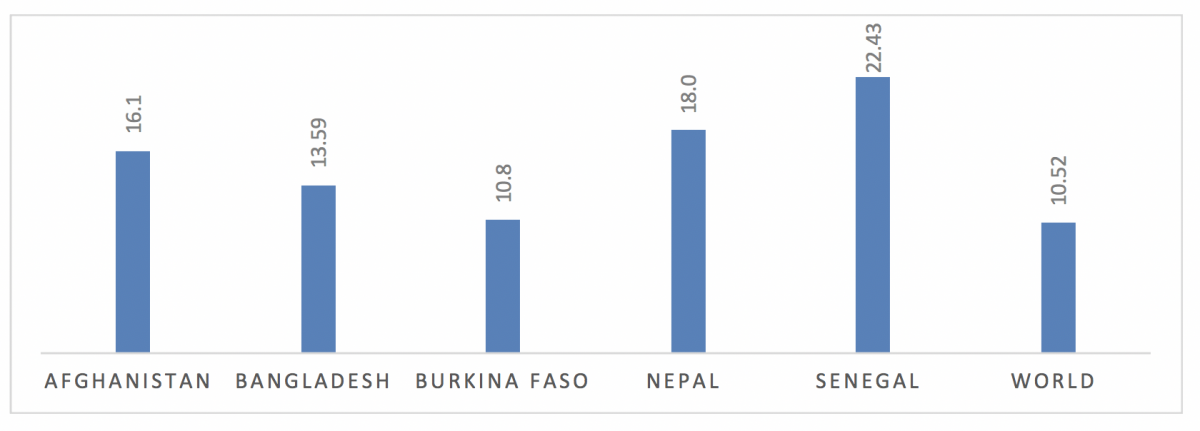

Some LDCs have been exporting ICT service in the recent past, which, as a percentage of total services exports are equal to or higher than the global average (see chart below). Increased exports in the ICT sector help these LDCs increase business confidence for attracting FDI to the sector, resulting in skills upgrades, technology transfer and access to managerial and technical skills. This will lead to an even higher increase in ICT services exports.

Chart: ICT service exports (% of service exports), 2017

Source: World Bank

Note: Based on latest figures available, including Senegal (2014) and Burkina Faso (2016).

Similarly, a joint study by ITC and Ali Research shows that in Asian LDCs, access to and affordability of infrastructure and ease of doing e-commerce transactions have led to increases in registered sellers from these countries on the Alibaba platform – at over 30% per year between 2015 and 2017.

Fostering international cooperation on FDI-related support

Recognizing the need for the global effort to help LDCs attract FDI, SDG 17.5 calls for the adoption and implementation of investment promotion regimes for them.Investment promotion agencies in LDCs have a clear role to play here but their limited capacity to adapt in a make or break moment means that they need critical support.

In this context, the Communiqué issued by the G20 shows a determination to "spare no effort" to support the global economy during and after the current crisis. Following this spirit, a proposal has been made to create a well-endowed "FDI facility" or alternatively to expand the mandate of the readily available framework of the Aid for Trade Initiative to include aid for investment focusing in particular on low-income countries. Such an initiative would be a welcome development for LDCs to build capacity to attract and retain FDI in these challenging times.

To conclude, given the continued constraints, the timely adoption of sound polices to create and strengthen FDI ecosystems and their effective implementation are a fundamental pre-requisite for LDCs to attract FDI in the context of COVID-19. Support from the international community would be equally critical to helping LDCs attract FDI with a view to building back better.

Inaction is certainly not an option.

----------------

The author wishes to acknowledge with thanks comments provided by Bostjan Skalar and well as inputs from Paulin Zambelongo and Fanan Biem

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.