New paper looks at the supply chain dimension of African trade during and post-COVID

On the African continent, COVID‑19 has strengthened the case for developing intra-African regional value chains and unlocking the continent’s business potential. The beginning months of the pandemic in Africa were marked by food shortages, price hikes and breakdowns in pharmaceutical supply chains.

[related-article]

COVID‑19-related breakdowns in supply chains resulted from an increase in transaction costs in foreign trade (driven by additional inspections, reduced hours of operation, road closures, border closures and increases in transport costs), coupled with an endemic reliance on imports. In 2018, 82.2% and 95.9% of Africa’s imports of food items, and medicinal and pharmaceutical products, respectively, originated from outside the continent.

COVID‑19 has magnified Africa’s reliance on imported pharmaceuticals (both final and intermediate products) and amplified the urgency to build competitive, resilient and robust value chains in this sector (see Figure 1). Not only are many of the main providers of Africa’s pharmaceuticals heavily hit by COVID‑19 (with main sources of imports being the EU-27, India and Switzerland), but many have also limited exports of medical supplies and medicines associated with the pandemic, putting many African countries in perilous positions.

In the wake of countries’ struggles to procure essential medical products from global suppliers to fight COVID‑19, there has already been a positive shift from global towards more regional and local supply chains. For example, in South Africa, U-Mask has redirected its production from protective masks for mining and agricultural companies to medical respirator masks. In Nigeria, the National Agency for Science and Engineering Infrastructure has produced the first “made in Nigeria” ventilators. Senegal, in collaboration with the UK and France, is prototyping a pocket-sized testing kit that will cost less than US$1, and in Ghana a diagnostic firm in cooperation with a local university has developed a test that delivers results in 20 minutes.[1]

Figure 1: Africa’s import sources of pharmaceuticals (2016–2018) and Africa’s export destinations for pharmaceuticals (2016–2018)

Source: Based on data from UNCTADstat

A recent survey jointly carried out by the Africa Trade Policy Centre (ATPC) of UNECA and International Economics Consulting Ltd. (IEC) on the impact of COVID‑19 on business and trade across Africa substantiates the ability of African firms to adapt and innovate in response to COVID‑19 challenges, including global supply chain disruptions. At the continental level, UNECA and AFREXIMBANK have also partnered to support the scaling up of manufacturing of COVID‑19 medical supplies that can be produced in Africa and sent across borders. This is expected to facilitate a regional approach to developing medical value chains based on comparative advantages and economies of scale. It will also help ensure that African countries without the capacity to produce these products can access them from within the region.

But the African Continental Free Trade Area (AfCFTA) agreement serves as the leading framework for boosting intra-African trade. Swift implementation will be crucial to fast-track the development of “made in Africa” brands embedded in competitive and robust regional value chains. In fact, a leading objective of the AfCFTA is to ‘stimulate production through the development of regional value chains, as well as ensuring that manufacturing, agro-processing and other activities across the continent are stimulated to supply the market’. The AfCFTA therefore offers an opportunity for the continent to recommit itself to industrial development, in a way that will reduce its high trade dependence on non-African partners, and to position itself more strongly in the face of future global shocks. Amongst efforts to counter the immediate effects of the pandemic, it remains instrumental to not lose sight of the landmark AfCFTA and its implementation, which has been pushed back to 1 January 2021.

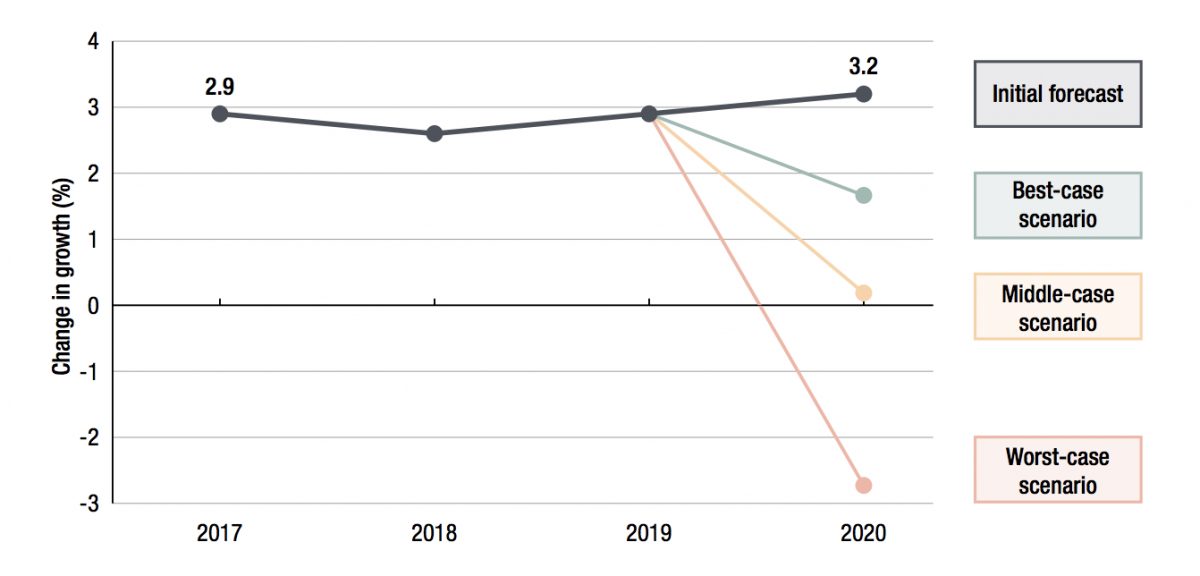

Figure 2: Expected contraction in growth from COVID‑19 across Africa

Source: UNECA

For African countries to benefit from diversification of global supply chains and develop resilient regional value chains, major efforts on industrial policy will be required to boost competitiveness so that Africa is able to match low-cost production in China and Southeast Asian countries such as Vietnam and Cambodia. The AfCFTA offers an opportunity for Africa to revisit and overcome the continent’s well-known non-tariff barriers (NTBs) and other constraints to boosting diversified trade and industrialisation.

Any development of regional and shorter supply chains is going to be facilitated by efforts to streamline trade flows in goods and services within the continent. The AfCFTA provides an institutional mechanism to address trade barriers as well as the means to channel investment to address existing bottlenecks. The pharmaceutical sector, in the name of public health, should occupy centre stage of the AfCFTA Agreement and should be prioritised in the initial stages of implementation. In this way the AfCFTA can serve as a key fundamental piece in the recovery after the crisis.

-----

[1] Primi, A., Mavroeidi, V., Toselli, M., et al. (2020) ‘Speeding up Africa’s response to Covid-19: what can technology, manufacturing and trade do?’. Paris: OECD.

----------------

Read full paper here.

Header image of a worker at a garment factory on the outskirts of Ho Chi Minh City, Vietnam- ©ILO/Aaron Santos via Flickr Creative Commons Attribution-NonCommercial-NoDerivs 2.0 Generic (CC BY-NC-ND 2.0) license. In text image of workers at the Socota garment factory in Madagascar - ©Fabrice Lehmann.

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.