New report dives into the details of shifting treatment, export markets and more

How countries are categorized in development and trade circles can mean a lot. Whether low income, industrialised, developing or fragile, certain classifications result in additional assistance, international support, market access and more.

For the 47 countries designated ‘least developed’ by the United Nations, leaving the category – or graduating – has a host of potential implications. Least developed countries (LDCs) benefit from preferential treatment in their participation in global trade like duty-free access, as well as in the multilateral trading system, i.e. the World Trade Organisation (WTO). Upon graduation, those benefits phase out.

With 12 least developed countries (LDCs) set to graduate in the coming years, clarity on what they should expect is a requirement. A new report, born out of a request by the LDC Group at the WTO, breaks down the impacts on a country’s trade and development cooperation landscape.

Here are the main takeaways:

1) On the whole, impacts will be limited.

Taufiqur Rahman, who is one of the report’s authors and LDC Unit Head at the WTO, said “LDC graduation has been associated with some fear of the unknown – our report finds that the impact of graduation for a large number of LDCs will be somewhat limited, though there are a few outliers. And, the impacts will differ in scope as well as in magnitude depending on each graduating LDC.”

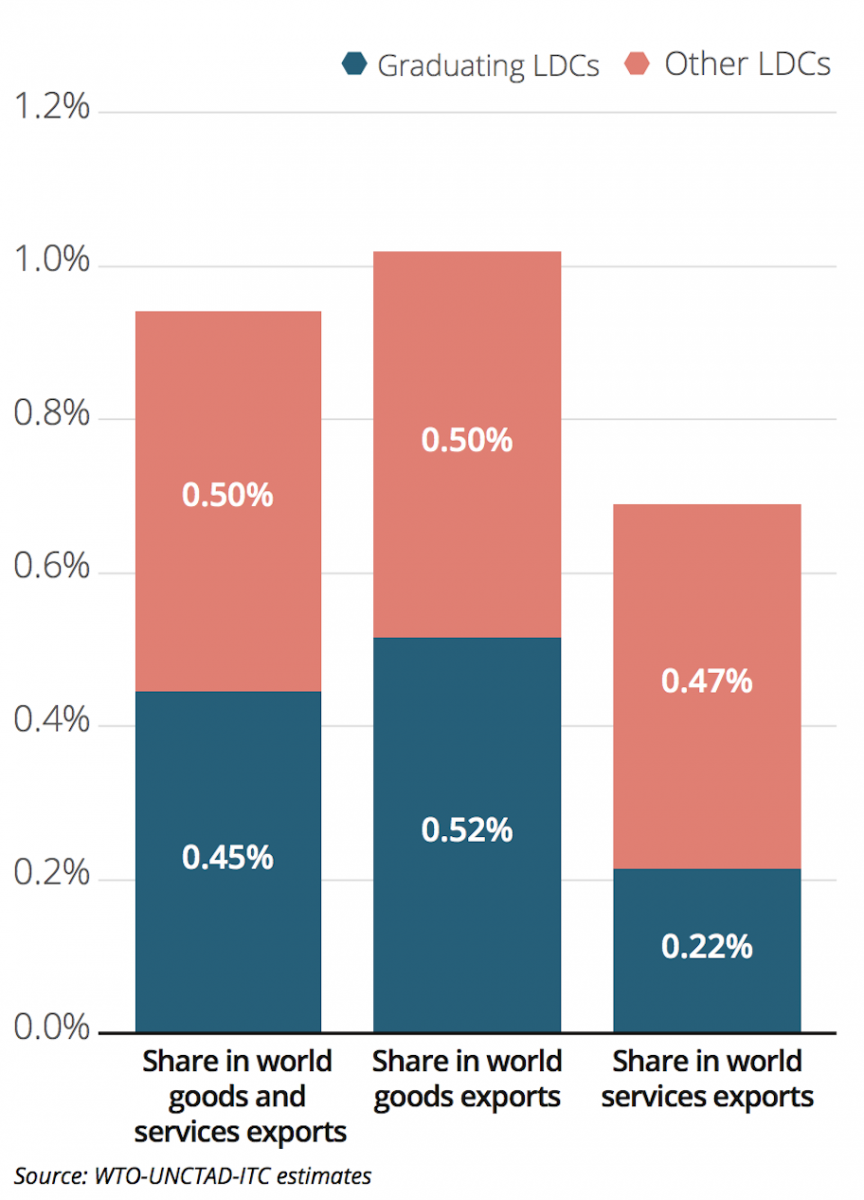

Share of LDCs in world exports, 2018

2) But… it depends on the extent of a country’s reliance on preferences.

An LDC receives preferences with market entrée as well as in the implementation of WTO rules and disciplines. But a country may not use available perks like duty-free and quota-free access, if the products exported are part of most-favoured nation (MFN) status and duty free in relevant markets, or exports are going to markets governed by regional agreements.

For example, 56% of Nepal's total exports go to India, and most of this trade takes place under a bilateral free trade agreement, rendering India's LDC preferences unutilized. Nearly 60% of Angola's exports to China are petroleum oils that do not depend on any LDC preferences given by China, as China does not levy any duties per the MFN status.

“Yes, LDCs are a group, classified in terms of per capita income and a few other indices. But they don’t have the same export structures or interests – they are all different. The extent of impact depends on the export baskets, the direction of exports and the dependence on preferences,” Rahman said.

Bangladesh is among the few graduating LDCs with a high utilisation of preferences. Its share of exports using LDC-specific preferences is 70%, compared to 26% for Myanmar. The report estimates that Bangladesh could see exports decline by 14% upon graduation. But, of all the graduating LDCs, Bangladesh also has the largest economy and is the largest exporter.

Tariff commitments and applied MFN duty rates by development status (%)

3) And… who they are trading with.

Countries set to graduate could feel impacts depending on their main trading partners.

“The EU is a major market for LDCs, and an important one where preferences are utilised. So when countries graduate, that will have an impact,” said Rahman.

With the EU’s Everything But Arms initiative and schemes provided by Canada and Japan, LDC exports enter those countries duty free. The loss of these perks would be a loss of margins at approximately 10% in clothing and 6-10% in certain fish products. And, there is also the loss of favourable rules-of-origin conditions that would especially affect clothing exporters.

"There are no perfect substitutes for LDC preferences after they graduate. A lot depends on the arrangements that graduating LDCs can secure with their trading partners to ensure a smooth transition," Rahman said.

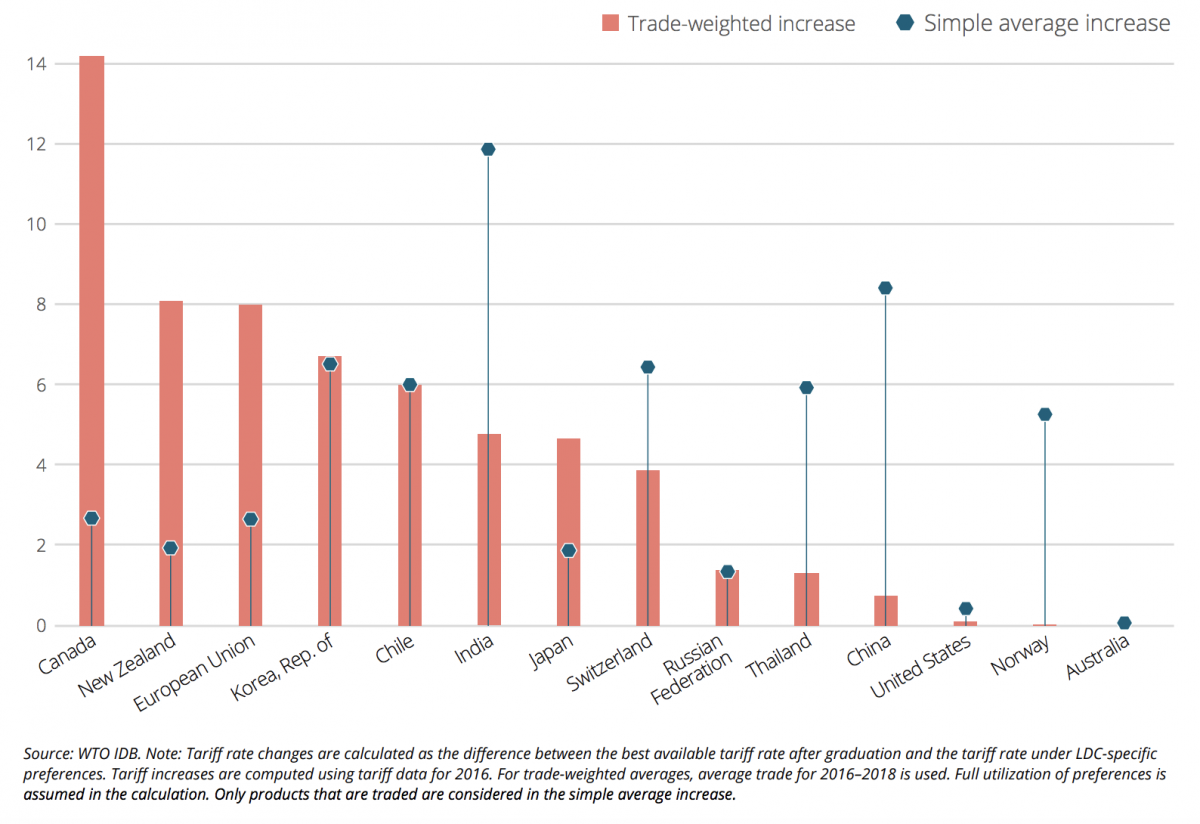

Expected tariff rate changes in destination markets (percentage points)

4) And… what they trade.

Some LDCs export commodities, some export minerals, some focus on garments. This export profile to a large extent determines their relations with trading partners. And this too drives the interests of the countries that are members of the WTO. Graduation means there is a bit of uncertainty with the continued use of export subsidies for industrial products or more notification obligations, including annual requirements related to domestic support for the sector.

5) And… their WTO participation.

The report finds that a lot depends on when a country joined the WTO.

“Some LDCs like Angola, Bangladesh, Myanmar and the Solomon Islands joined in 1995 when there were more flexible conditions to join. The accession process has become more rigorous, for example when Nepal, Vanuatu and Lao PDR came in, so those countries have undertaken more commitments,” Rahman said.

Intellectual property legislation is an area where graduated LDCs would need to give particular attention, though several of them are ahead in enacting laws and regulations covered under the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

6) Finally, COVID-19 will change things.

Coronavirus is subduing global trade – that much is clear. But its actual repercussions for countries on the path to LDC graduation remains hazy.

Rahman said, “Our analysis is irrespective of the developments of COVID; it is valid when a country has graduated. Definitely what is going on in the world will have an impact on the timeline of graduation or the prospects of graduation. Vanuatu, which is set to graduate this year, was hit by a cyclone and Angola by the drop in oil prices, and in Bangladesh garment exports are being affected. With oil or clothing or tourism, the three sectors are hit hard. And there is not only the demand shock but the supply side disruptions, because you are sourcing intermediate inputs from countries like China and because of travel restrictions things are not as smooth.”

“To some extent the merchandise revenues can recoup. But the tourism revenues if you don’t earn it then it’s gone.”

With trade and economic data still coming in since the pandemic erupted, how LDC graduation shakes out remains to be seen. But, this fresh analysis offers clear guidance for countries aiming for a reappraisal of their economies, trade status and vulnerabilities, laying the groundwork for as smooth a graduation as possible.

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.