The multilateral trading system and the body of trade rules enshrined in the World Trade Organization (WTO) rulebook have been the cornerstone for trade-led economic development in recent decades. Trade and foreign direct investment flows have created an amazingly efficient web of global supply chains that have generated a steady increase in global prosperity, economic development and poverty reduction. For the group of least developed countries (LDCs), exports are often covered by existing unilateral preferential schemes in most OECD countries and developing countries.

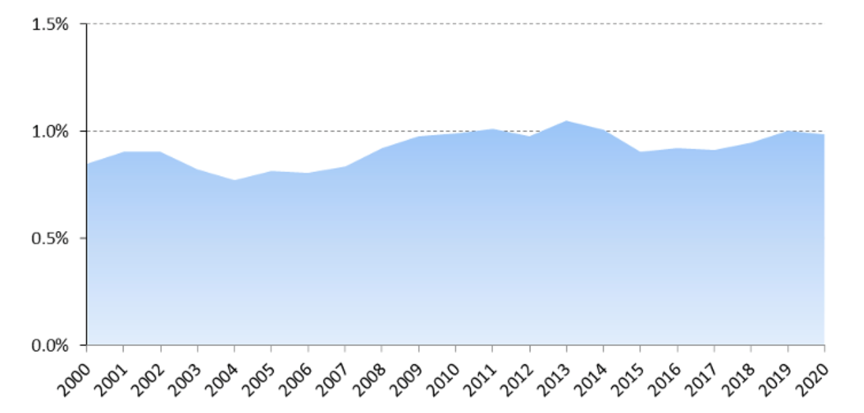

However, despite such a favourable context, LDCs have persistently low participation in world trade. Despite the growing share of developing countries in world trade over the last decade, LDCs have not benefited from such a trend. Their share of world trade remained relatively stagnant during the last ten years, and has experienced a slight decline since 2013 (Figure 1).

Figure 1: Share of world exports by least developed countries (%)

Source: Antimiani and Cernat (2021), “Untapping the full development potential of trade along global supply chain: “GVCs for LDCs” proposal”, Journal of World Trade 55, forthcoming.

This low level of participation is even truer in global value chains (GVCs). Most LDCs have achieved limited export diversification and have been dependent on exporting a few commodities or specific products like minerals or agricultural items. Despite this concentrated export structure, many third countries’ exports contain a non-negligible share of LDC value-added, notably textiles, processed food and energy intensive products (Figure 2).

Further, due to the COVID-19 pandemic, LDCs show a weaker recovery growth rate (14.1%) compared to developing (34%) and developed (14.1%) countries.

An additional problem for LDCs is that the preference margin between most-favoured nation (MFN) tariffs and the ones offered to their exports in unilateral preferential schemes, even when duty and quota-free, is continuously eroded by the growing number of free trade agreements being concluded around the world.

Figure 2: Share of LDC value added in sectoral exports, by main exporting regions

Source: Antimiani and Cernat (2021), “Untapping the full development potential of trade along global supply chain: “GVCs for LDCs” proposal”, Journal of World Trade 55, forthcoming.

GVCs for LDCs

Instead of preferential schemes based on ‘direct’ LDC exports, under the new GVCs for LDCs initiative, WTO members would offer duty-free access to LDC value-added that ‘travels’ inside finished products exported worldwide by any other WTO member. Hence, LDC exports will remain duty-free across the entire global supply chain, thus fitting the ‘Made in the World’ logic that the WTO has been advocating for several years.

When looking at the composition of LDC exports, roughly 25% of LDC exported value-added is in fact further processed and embodied in third country exports. GVCs for LDCs would offer additional and untapped potential not only for greater participation of LDCs in global trade but also for those exporters that incorporate LDC value-added in their products. This potential stems from the fact that LDCs remain dependent on exports of upstream products that are further processed along global supply chains and (re-)exported as part of processed products manufactured in non-LDC countries.

For instance, consider the case of tropical fruits (e.g. mangos) exported by LDCs. Currently, such products are offered duty-free and quota-free in certain preferential schemes for LDCs (e.g. the European Union’s Everything but Arms initiative). As such, nothing can be done to offer additional preferential market access for LDC exports of tropical fruits to Europe or any other country with an EBA-like scheme. But if the LDC tropical fruit is embedded in a third country processed food export (e.g. yoghurt or ice cream) which faces a 15% most-favoured nation tariff in another country, the LDC mangos are also indirectly subject to the 15% tariff. Under the GVCs for LDCs initiative, the LDC tropical fruit content value will be deducted from the dutiable value of the processed food items, leading to an increase in trade and a boost to LDC exports of mangos along the supply chain. Therefore, unlike existing unilateral schemes, the GVCs for LDCs multilateral scheme can offer a further boost to LDC exports and a more significant global positive impact.

This scheme will be based on a uniform set of value-added rules of origin, which will ensure that the tariff reduction will be proportionate to the LDC value-added content.

Untapping the global value chain potential

To assess the main economic effects of this scheme, we used the Global Trade Analysis Project (GTAP) dynamic computable general equilibrium modelling framework. We estimated a multilateral scenario where each country receives a cut in tariffs, on a multilateral basis, on its exports proportionate to the LDC valued-added embodied in the goods exported. The proportionate tariff reductions worldwide (based on share of LDC value-added contained in third country exports) takes into account not only intermediate goods but also the value of mode 5 services originating in LDCs.

Looking at total trade effects, global trade would increase by US$23 billion, and the share of LDC trade in world trade would increase by roughly an extra tenth of their current share of world trade. The initiative could enhance the LDC value-added embodied in their own exports and exports by other countries. Figure 3 shows the sectors with the most significant increase in their own LDC domestic value-added. LDCs will increase the value-added embodied in their exports by more than $5 billion, with some sectors (textiles, metal products, other primary, wood and chemicals) showing the highest results. LDCs would increase on average by 2% their domestic value-added content in their exports thanks to the new initiative.

Furthermore, and probably most relevant, the GVC for LDC initiative could reduce the excessive specialisation of LDCs in agrifood production, increasing the role of these countries in supplying intermediate inputs for a wide range of manufacturing sectors.

Figure 3: Top ten LDC sectoral exports with the highest increase in value-added ($ million, 2025)

Source: Antimiani and Cernat (2021), “Untapping the full development potential of trade along global supply chain: “GVCs for LDCs” proposal”, Journal of World Trade 55, forthcoming.

However, this does not lead only to LDC direct export gains. Since the initiative offers preferences at the multilateral level for products incorporating LDC inputs, LDCs will also increase their value-added embodied in third country export, improving especially the value chain integration between LDCs and other developing countries exporting to world markets.

Conclusions

Despite the rebound in trade in recent months, the long-term effects of the COVID-19 pandemic will likely be felt for years to come. The International Trade Centre estimates that global export potential in 2025 is now 3.4% lower than before the pandemic, due to downward revisions in GDP growth forecasts. Estimates of export potential fell across all geographic regions, with Africa (-7.0%) and LDCs (-6.4%) being most affected.

The GVCs for LDCs scheme shows that there is considerable room for the global trading system and new multilateral initiatives to offer additional impetus for the participation of LDCs in international trade. Equally significant, the increase in LDC exports is at nobody's expense: all countries benefit from an increase in their GDP and economic welfare, given that this new multilateral initiative creates new market opportunities for all countries incorporating LDC inputs in their exports.

----------------

Authors’ Note: The opinions expressed herein are those of the authors and do not necessarily reflect an official position or the views of the European Commission.

----------------

A version of this article was first published by VoxEU here on 24 June 2021

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.