This article was originally published on the UNIDO website on 20 November 2020.

Industrial development in Africa has been sluggish for some decades. Now, as the effects of the COVID-19 pandemic kick in, hopes for better progress, at least in the short term, appear to be fading. But if countries grasp the right opportunities, the next decade can deliver the industrial change needed to meet the challenges ahead.

Industrialization and development go hand in hand. There is hardly a country in the world that has developed without building a strong manufacturing base. But for Africa – sometimes referred to as the continent of the future – the fruits of industrialization have often seemed just out of reach.

The continent’s development progress ground to a halt in the 1980s as war, disease, famine and poor governance overtook the political and social landscape. A debt crisis, ill-designed structural adjustment policies and a crash in commodity prices left Africa poorer at the end of the decade than at the beginning. Many of the same problems persisted for much of the 1990s. By the start of this millennium, the Economist magazine had dubbed Africa the “hopeless continent”.

Over two lost decades, collective efforts to push industrial development achieved little. The first Industrial Development Decade for Africa (IDDA), launched in 1980 by regional organizations and supported by the United Nations Industrial Development Organization (UNIDO), ended in failure, suffering from insufficient national buy-in and funds. The second decade came at a time of dwindling commodity prices, and though it saw more private-sector and grassroots involvement, progress was negligible.

Industrialization was pushed to the sidelines. Although the impetus from policymakers and governments grew throughout the 2000s, it wasn’t until 2016 that coordinated action was once again launched under the Third Industrial Development Decade for Africa (IDDA III).

Now, half-way through IDDA III, is there hope of success where previous initiatives failed?

Both the domestic and international context have changed radically over the past two decades. The goals of IDDA III are not only supported by UNIDO and the African Union (AU) but by other UN agencies, by African governments at the highest level, by the private sector, development organizations and financial institutions. These goals are linked to the AU’s 2063 agenda to drive development in Africa and embedded in the Sustainable Development Goals (SDGs), particularly SDG 9 on industrialization, infrastructure and innovation. There has also been a turnaround in support for industrial development policy, which is now recognized as playing a key part in achieving economic development and social goals on health, education and well-being, as well as a fresh approach to its implementation through the creation of new business models and an innovation drive.

This scale of commitment brings dynamism and funding that were previously lacking, leading to a step-up in the number of technical assistance projects and programmes by UNIDO and other partners. From two Programmes for Country Partnership in Africa in 2015, UNIDO now runs eight, each with greater levels of engagement and funding than before. In Ethiopia, for example, four new agro-industrial parks were completed in 2020, and over $600 million has been earmarked by a variety of partners to increase government resources.

Despite ongoing challenges and a levelling off in GDP growth since 2017, many countries have made significant strides in boosting their industrial and agro-processing sectors, notably in food and beverages, leather, textiles, automotive and heavy machinery. The diversity needed to allow manufacturing to really take off has not yet taken root, but there are pockets of success.

Ghana, for example, has made progress through its adoption of a clear industrialization strategy, focusing on improving the business environment and the development of special export zones (SEZs). In the three years to 2019, the industrial sector was a major component in the country’s growth, rising by over 10 per cent a year. (AfDB Ghana Economic Outlook 2019)

Uganda’s industrial sector jumped in 2019 from 20 per cent of GDP to closer to 30 per cent as a result of strong investment in manufacturing. Around 80 per cent of foreign direct investment into Ethiopia in recent years has been destined for the manufacturing sector, through the development of industrial parks (ODI). The result has been a rapid rise in growth, jobs and exports of horticulture products, textiles and clothing, with this last jumping tenfold since the early 2000s.

There is also a thriving entrepreneurial sector in many countries – often missed in industrial statistics because of small company size and the large number of firms still operating in the informal economy. Although many of these enterprises cannot be classed as industrialized, they form part of a groundswell of business dynamism that is helping to raise incomes and develop locally supplied domestic consumer markets as workers move increasingly from the land to a variety of jobs in the city. The past five years have also seen a huge rise in investment in African start-ups, including e-start-ups, with South Africa, Kenya, Nigeria and Egypt leading recipients of the $1 billion invested in the region in 2019.

In addition, the African Continental Free Trade Area (AfCFTA), worth $2.5 trillion, comes into operation in early 2021. Although trade between African countries, at 17 per cent of exports, is far below levels seen in Europe (67 per cent) and Asia (60 per cent), almost half of that trade is in manufactured goods – considerably higher than in other regions.

Developing economies of scale by providing continent-wide access for people and goods across 54 countries, AfCFTA should improve allocation of resources, raise competition, boost competitiveness and contribute to more sustainable growth in the long run. If successful, it could provide an environment for local industry to grow at a time when the pandemic has further subdued demand in Africa’s traditional export markets, while offering an African counterpoint to the growing global trend for market regionalization (most recently seen in the signing of the world’s largest trade area in Asia, the Regional Comprehensive Economic Partnership).

These developments will also be supported by Africa’s rising middle class of consumers, defined by the African Development Bank as those who can spend between $2 and $20 a day. By the middle of the century, it expects this middle class to reach around 40 per cent of the population, which, by then, will mean over one billion people.

Nevertheless, while many of the building blocks for success are in place in a way they weren’t two decades ago, old obstacles persist.

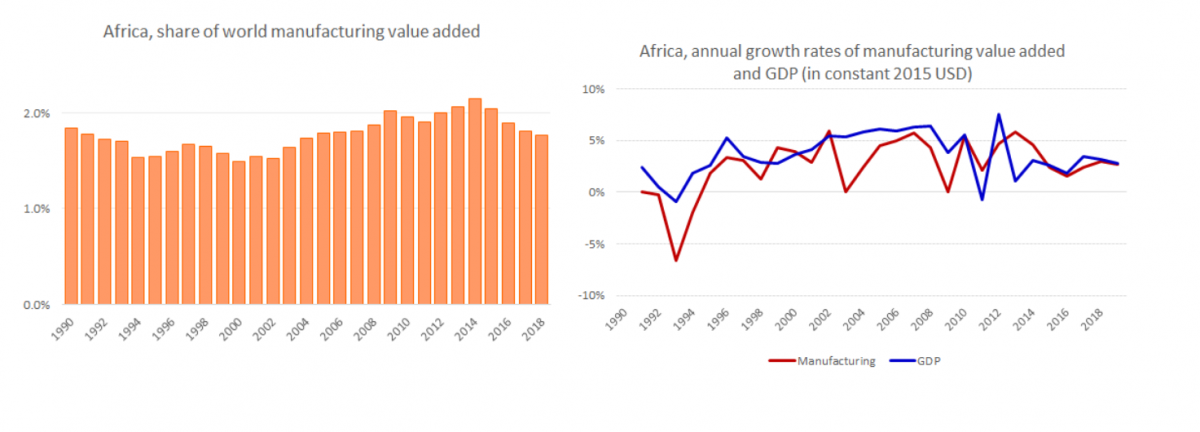

Africa is still the world’s least industrialized region. Its share of global manufacturing value added (MVA) remains tiny at around 1.8 per cent and has even edged downwards since 2014. Its MVA as a share of GDP, taken as a measure of industrialization, has stagnated over the past 10 years. In 2018, the latest year for which data are available, it stood at 10.5 per cent compared to more than 16 per cent at the beginning of the 1980s – a sharp contrast to MVA/GDP of over 25 per cent reached in recent years by developing Asia.

Some have argued that the continent may have already missed its chance. Competition from more developed markets, especially East Asia, shifts in demand and rapid technological change, all make it harder for the majority of still resource-dependent African economies, where business costs are high and productivity low, to follow a traditional route to industrialization.

A new threat – and the path ahead

There is also a major new threat to African economies: the COVID-19 pandemic looks certain to hit them hard, despite the fact that the health crisis has been less severe there than in other regions.

The region is facing its first major recession in 25 years. The World Bank estimates losses in GDP could amount to between $37 billion and $79 billion in 2020. Disruption to trade and supply chains and an ongoing drop in demand, especially from Africa’s biggest trading partner, China, is hitting growth, and investment flows have stalled. UNCTAD says Africa’s merchandise exports could fall by as much as 17 per cent this year, squeezing tax receipts and cramping governments’ ability to maintain public spending and invest in the policies needed to boost industrialization.

Manufacturing is expected to suffer heavy losses, especially in the automotive, airline, energy and basic materials sectors. A large number of African policymakers expect overall industrial revenue to drop by at least 25 per cent in 2020, according to a new UNIDO survey.

The crisis threatens to cut jobs, intensify migration, increase poverty and hinder the fight against climate change. These challenges make it all the more urgent to build resilience and sustainability, further strengthening the case for industrialization.

To get there, Africa must see the pandemic as an opportunity to drive change, to invest in new business models, support innovation and diversify its products. The post-COVID-19 change in global markets gives added importance to developing local and regional supply chains to take advantage of a growing domestic market.

This will mean giving full support to the new AfCFTA. Additionally, it will require concentrated measures to support manufacturing sector businesses, including services in technology upgrading, quality compliance capacity development, product development, marketing and investment promotion.

Infrastructure development needs to be a priority too, driven by the state with private-sector support. Poor-quality roads and unreliable transport contribute to the high cost of doing business in many countries, harming competitiveness. For example, in some countries in sub-Saharan Africa the cost (per unit distance) of transporting goods could be up to five times higher than in developed countries.

At the same time, more investment in internet connectivity is needed to prepare for a digital future, as well as improvements to the continent’s energy infrastructure, building on green technologies such as hydro and wind power.

Africa also needs to invest more in education and skills, making science and technology a priority to take advantage of the ongoing digital revolution.

But economies must get the basics right as well. This means focusing on upgrading less high-tech sectors such as food and beverages, garments and paper in local and regional markets. And with 60 per cent of the working population still employed in agriculture, investing more in agribusiness will help to boost incomes and provide new jobs.

The pandemic has shown the need for self-reliance and resilience, and the reforms needed to transform African economies must build both. But it has also demonstrated the importance of partnership and cooperation.

Despite the challenges, Africa has transformed both its political and economic landscape in the past two decades. This transformation and commitment to change at both national and international level mean the goals of IDDA III are now more achievable than at any time in the past.

By working together, the African future may finally be within grasp.

Header image - ©BeatingBetting.co.uk via Flickr Creative Commons Attribution 2.0 Generic (CC BY 2.0) license.

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.